When 0% Is Not Free Money

Out of the envelope I pulled this astounding piece of junk mail yesterday.

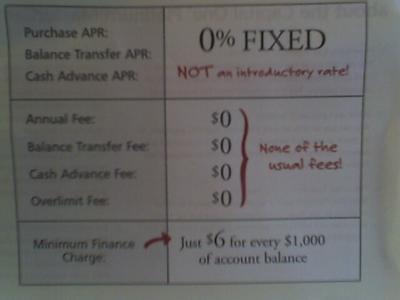

NOT an introductory rate!

First, don't confuse no interest with no finance charge. Instead of an interest rate, this Platinum Mastercard From Capital One charges a fixed finance charge of $6 per $1,000 financed. This is $48 a year or 4.8% interest. Not zero, but still not bad, right? It gets worse.

Why are they doing this? Well, in the letter to GSully from Pat W. Johnston, Direc

tor of New Accounts, (funny how you can't tell if the letter is from a man or a woman or even a real person) Pat says (s)he(it) thought we might be "tired of confusing interest rates and mysterious fees that come with most credit cards." Except I couldn't help but be confused that despite there not being any interest I would still be paying a boat load of interest. Once I got that through my thick skull, I decided that I would much rather be confused by all those interest rates and fees.

tor of New Accounts, (funny how you can't tell if the letter is from a man or a woman or even a real person) Pat says (s)he(it) thought we might be "tired of confusing interest rates and mysterious fees that come with most credit cards." Except I couldn't help but be confused that despite there not being any interest I would still be paying a boat load of interest. Once I got that through my thick skull, I decided that I would much rather be confused by all those interest rates and fees.Thankfully, in the P.S. to the letter, Pat says that "Since the Platinum Card from Capital One is so unique (or do they mean such a bad idea), [they] are happy to answer you questions. Just call Capital One at 1-866-346-7128.

Unfortunately, I can't find any information on the Capital One website (it must be a secret product for "special" customers), so I took some pictures of the offer.

0 Comments:

Post a Comment

<< Home